My Role as a Divorce Financial Planner

Certified Divorce Financial Analyst®

One hires a Certified Divorce Financial Analyst® (CDFA®) professional to gain access to an expert who brings the financial complexities with divorce to the forefront so you avoid costly mistakes. As a CDFA® professional, I share with you and your team relevant and specific financial knowledge critical in divorce, as well as constraints and alternatives. I also foster successful mediation, work with your other financial professionals, or act as an expert witness in court.

CERTIFIED FINANCIAL PLANNER™

As a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional I posses skills necessary to craft a comprehensive financial plan that maximizes your future goals. This forward looking picture helps you make, from a position of strength, the right divorce decisions. Also, as a CFP® professional, I bring in elements of financial psychology to help you better understand the financial emotions often running rampant in divorce.

Key Benefits for You

Support for Your Team

Support for Your Team

Financial Advice Only

Financial Advice Only

Fiduciary Obligation

Fiduciary Obligation

Avoid Mistakes

Avoid Mistakes

Simplification

Complexity Zaps Financial Energy

Transition Plan

Transition Plan

Education

Education

FinPsych

FinPsych

Lower Financial Stress

Financial Stress Occurs When Your Confidence is Low

Services Common in Divorce Financial Planning

Net Worth & Cash Flow Components

- Data Collection and Organization.

- Develop Personal Financial Statements

- Pre-divorce Budget & Cash Flow Analysis

- Post-Divorce Budget Projections

- Identify Tax-Related Constraints and Concerns

- Formulate Cost Basis on Assets and Property

- Develop/Review Options for Equitable Settlement

- Support Legal, Accounting, Financial and Other Professionals

Asset Components

- Explain Retirement Plan Rules and Options

- Strategize and Review Taxable Investment Accounts.

- Outline Options for Balanced Savings Contributions.

- Review and Strategize Around Executive and Incentive Compensation Plans.

- Outline Procedure for Retirement Account Transfers, Including QDRO Transfers.

- Estimate Pension Marital Asset Value.

- Develop Strategy to Support Education Goals.

- Develop Strategy for Business Succession or Continuation.

Liability and Tax Components

- Formulate Cost Basis on Assets and Real Estate.

- Quantify and Explain Embedded Future Taxation.

- Organize Debt, Develop Elimination Strategy, and Outline Potential Exposures.

- Determine if the Strategy with the Marital Home Matches Mortgage Underwriting Guidelines.

- Explain Taxation around Support, as well Marginal Income Taxation. Develop Strategy to Minimize Taxation

Protection & Estate Components

- Review of Property & Casualty, Life, Disability and Health Insurance – Explain Options and Considerations.

- Identify Future Liability and Coverage Exposure.

- Assist with Pre-Qualification Process for Future Insurance Requirements.

- Outline Options to Retain Health Insurance Coverage.

- Assist with Adjusting Wills, Directives, Powers of Attorney, and Trusts.

- Properly Structure beneficiaries.

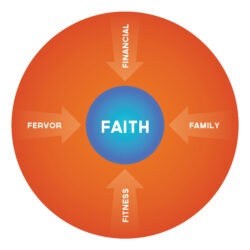

Combine Prosperity Coaching with Divorce Financial Plan

Every client has the choice to incorporate prosperity coaching with a divorce financial plan. This is for divorcees who are looking beyond their money, and want to recover time, energy, and health so they can get back to being the person they are capable of being, and live the life they are capable of living.